- Home

- Remote Identity Verification

- eIDV – Electronic Identity Verification

- How eIDV Works: Step-by-Step Electronic Identity Verification

How eIDV Works: A Quick Look at Electronic Identity Verification

ScreenlyyID’s streamlined eIDV checks confirm user identities by comparing personal data against global databases and watchlists.

- Setup in Minutes

- No Credit Card

- Cancel Anytime

Key Benefits

Trusted Data, Verified Identities:

Key Benefits of eIDV

ScreenlyyID’s advanced eIDV solution uses robust data checks and automated workflows to ensure compliance, prevent fraud, and enable swift, secure transactions.

Why eIDV Matters

Understanding the Basics of Electronic Identity Verification

Electronic identity verification (eIDV) helps businesses validate user credentials seamlessly. By matching details against trusted data sources, ScreenlyyID reduces manual reviews, minimizes fraud risks, and enables compliant onboarding. This streamlined approach fosters trust between you and your customers.

Efficient Layered Checks

Key Steps in ScreenlyyID’s Electronic Identity Verification

ScreenlyyID’s eIDV approach captures personal details from a valid ID or user input, then compares that information against multiple databases in order to gain a match on the personal information.

Core Benefits and Features

How Does eIDV Streamline Electronic Identity Verification?

ScreenlyyID’s eIDV platform delivers a zero-friction approach, eliminating the need to scan physical IDs. Instead, it reuses personal data from existing onboarding forms, instantly cross-checking details against global watchlists and official records. By reducing manual steps and automating risk checks, businesses gain a faster, more secure identity verification process.

Simplified eIDV Process

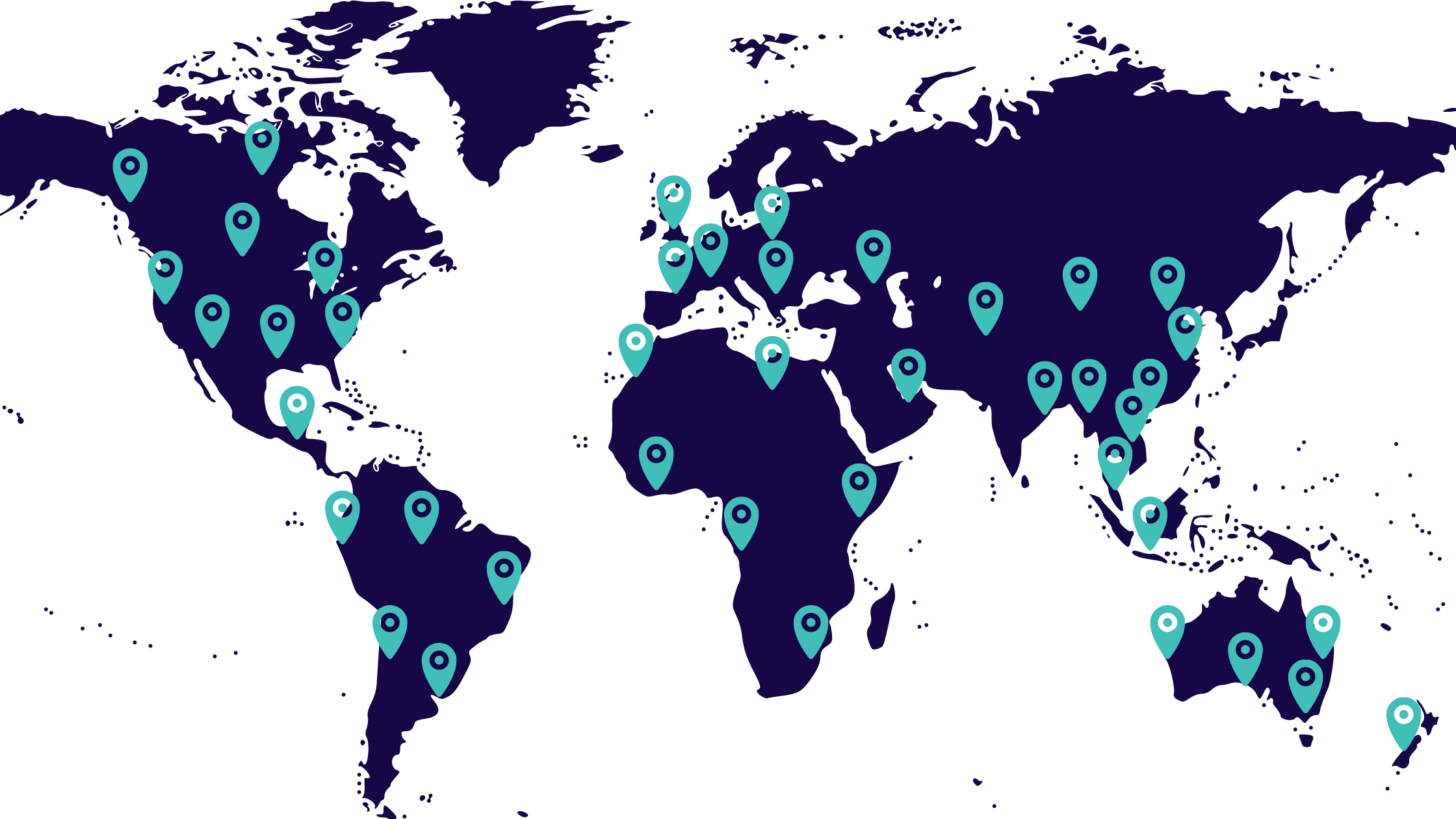

Global Reach: ScreenlyyID’s Electronic Identity Verification Network

ScreenlyyID enables electronic identity verification across 50+ countries by matching personal data against 300+ trusted data sources. Whether through a single API or directly via the ScreenlyyID platform, businesses can verify users globally, instantly and securely, without the need for manual document handling. This global coverage supports compliance and user onboarding at scale.

AML, KYC, and Beyond

Staying Compliant with Electronic Identity Verification Standards

ScreenlyyID’s electronic identity verification system meets regulatory demands by aligning with AML, KYC, and other guidelines. Automated checks record every action, creating a clear audit trail. As a result, businesses maintain consistent compliance and reduce potential legal risks.

More Features

Unleash advanced KYC verification capabilities

Experience real-time analytics, no code integrations, advanced risk assessment, and powerful APIs to manage your organizations KYC Verification.

Frequently Asked Questions

We're here to answer all your questions

Everything you need to know about ScreenlyyID's Electronic Identity Verification solution. Can’t find the answer you’re looking for? Please chat to our friendly team.

eIDV stands for electronic identity verification. It’s a process that uses digital tools and data sources to confirm someone’s identity quickly, accurately, and securely.

ScreenlyyID’s solution combines advanced technology with robust data coverage. This approach delivers accurate, automated checks that save time, reduce fraud, and help meet regulatory requirements.

Absolutely. ScreenlyyID employs encryption, secure servers, and stringent data-handling policies to safeguard personal information at every step of the eIDV process.

Businesses in fintech, banking, e-commerce, gaming, and more can all benefit from electronic identity verification. Anywhere user authentication is crucial, eIDV helps streamline and protect onboarding.

Most verification checks are completed within seconds, thanks to powerful integrations and automated workflows.

Contact Us

Talk to an expert

Let's connect to discuss the possibilities and find the perfect solution for your business needs.

Complete the form, and one of our experts will reach out to you. You'll discover how our solutions can tackle your specific challenges, optimize your operations, and drive your growth.

- Explore industry-specific use cases

- Identify the best solution for you

- Get enterprise pricing

- Book a demo

Lets Connect....

Start Today

Start Verifying Customers Today

See how easily ScreenlyyID integrates verification into your onboarding process.